Behind the Numbers: Meet Collin County's Tax Assessor-Collector Scott Grigg

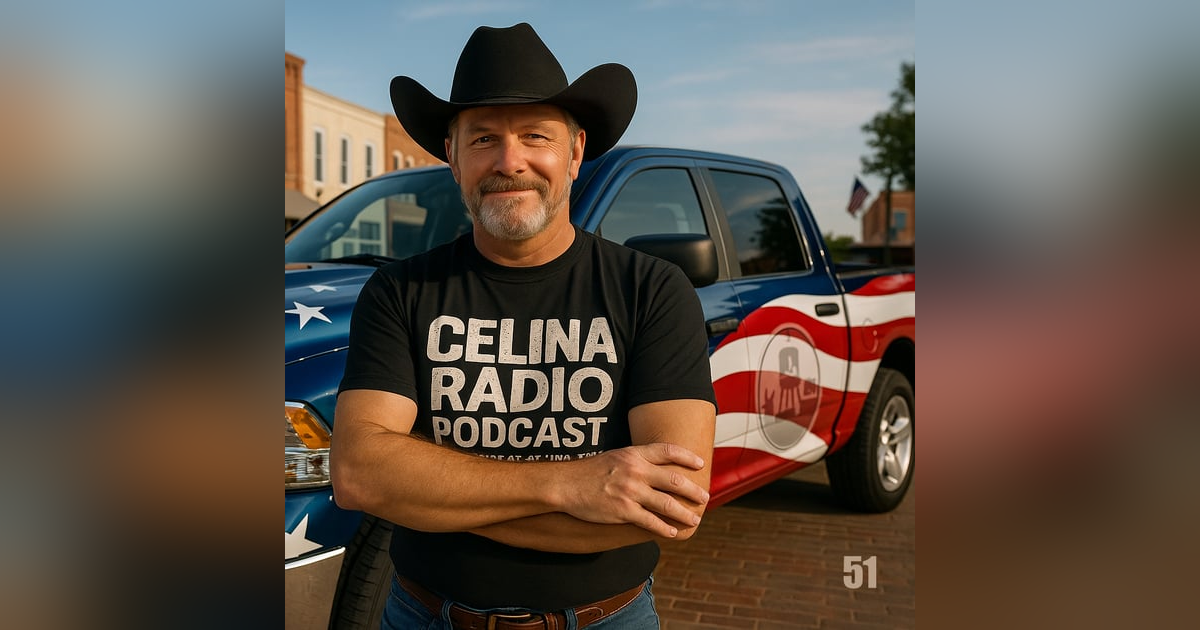

In this enlightening and candid episode of the Celina Radio Podcast, host Ron Lyons sits down with newly elected Collin County Tax Assessor-Collector Scott Grigg—a man with a Ford truck full of patriotism and a sharp eye for numbers.If you’ve ever...

In this enlightening and candid episode of the Celina Radio Podcast, host Ron Lyons sits down with newly elected Collin County Tax Assessor-Collector Scott Grigg—a man with a Ford truck full of patriotism and a sharp eye for numbers.If you’ve ever had questions about your property appraisal, tax protests, or the inner workings of the DMV-style chaos, Scott brings clarity, wit, and wisdom to it all.

Discover how $2.4 billion was collected in his first quarter alone, why attitude and organization matter when protesting your property values, and what really happens behind those closed doors at the Appraisal Review Board.

Plus, learn the difference between appraisal notices and property tax bills, get pro tips for winning a protest, and hear how Scott’s faith, integrity, and community focus have shaped his leadership—even when the campaign trail got tough. Whether you're a seasoned homeowner, a first-time buyer, or just someone who dreads getting mail from the county, this episode is full of practical insights, laugh-out-loud moments, and a refreshing perspective on public service done right.

Tune in now at CelinaRadio.com or search Celina Radio Podcast on your favorite platform.

Ron Lyons (00:06):

Welcome to the Celina Radio podcast, the voice of Celina, Texas, where the streets on the square are still

made of brick. The pride is real, and the Facebook threads are just as entertaining as Friday night football.

Celina is growing fast, but at our core, we're still a small town built on faith, family, and fierce

community pride. And sure, we've got our quirks, we passionate debates, our small town politics, and a

whole lot of people around here who aren't afraid to speak their mind, but that's what makes this place

special. Whether you're a lifelong local or brand new to town, this is where we celebrate the heart of

Celina. And occasionally we stir the pot just a little bit. So, let's talk Celina, Texas, unfiltered.

Unapologetic and proud to call Celina, Texas Home.

Ron Lyons (01:08):

Alright, guys, I'm here today with somebody that you might not actually know just yet, and the reason

that you wouldn't know him yet is because he's been in his newly elected office only for a short time. His

name happens to be Scott Grigg, not with an S on the end. Is that right?

Scott Grigg (01:25):

That's right.

Ron Lyons (01:26):

Scott Grigg. And you happen to have been elected as what?

Scott Grigg (01:30):

I am the Collin County Tax Assessor,

Ron Lyons (01:32):

Collin County Tax Assessor. So let me just ask you this, like right off the bat, uh, it, back in the day,

whenever I was a police officer, a lot of times, depending on who I was talking to, you'd be like, oh, uh,

who are you? Or whatever. You introduce yourself and you're like, and what do you do? Oh, I'm a police

officer. It changed sometimes the expression on their face. Do you ever run into that as the tax collector?

Scott Grigg (01:54):

Oh, absolutely. As soon as you say tax collector, sometimes there's even a murmur. Uh, <laugh> almost a

boo.

Ron Lyons (02:00):

Right.

Scott Grigg (02:01):

But I, I always try to remind them, you know, it's okay guys. Jesus hung out with them, <laugh>. It's

okay.

Ron Lyons (02:07):

So it, it is a different deal. And how long have you actually been in that position now? I know you just

recently won the election. Was that back in, uh, November?

Scott Grigg (02:17):

Yes. November I took off. I took my oath of office on January 1st. Of course, that'd been a holiday. Uh,

got my staff sworn in on the second. We've been rocking and rolling ever since I've collected, um, that

first quarter, almost $2.4 billion.

Ron Lyons (02:36):

Wow. That's a lot of money. That's a lot of money. So what did you do

Scott Grigg (02:40):

Prior to

Ron Lyons (02:40):

That? Because you, you know, you weren't born and grew up and probably didn't, probably didn't grow

up back in the day saying, I wanna be a tax assessor collector, but what'd you do just before this?

Scott Grigg (02:50):

Right before this, I was actually working with our courts. I was a legal clerk for one of our justice courts

down in Plano.

Ron Lyons (02:56):

Oh, wow. Wow. That's very, very interesting. You know, as long as I've known you, I never knew that

you did that. So that's very interesting. And you, you've gotta have some sort of like accounting

background or something, I would assume. Is that, is that correct?

Scott Grigg (03:08):

That is correct. I'm a certified fraud examiner. Okay. I spent, um, over three decades in accounting,

finance, um, for major Fortune 500 companies. I kind of joke around with some of my best friends.

Walked into a stadium one day. Yeah. My best friend looked at me and said, look at your resume. I'm

like, what are you talking about? Looked up at the scoreboard, Tyson Foods, Walmart, Coca-Cola,

Aaron's Lease owned furniture. I have been a senior auditor for all four of those companies. Oh,

Ron Lyons (03:42):

Wow. Wow. So definitely have that. So let me just ask you this, and we're gonna talk a little bit about

who you are and where you live and get all that kinda stuff. We'll talk about all that. But it's fascinating to

me because math is the very reason, let me just say it like this. My daughter asked me recently why I

wasn't a doctor, and I said, because of math. So I, I'm wondering when I find people who are good with

numbers and math and stuff like that, it's intriguing to me. Have you always been really good at math?

Scott Grigg (04:14):

Yes. God's given me some kind of gift that I can look at a set of numbers and just, if there's something

odd, it's gonna stand out to me and I can see it. And it's like, uh, where, where did that come from? And,

um, recently we were out of balance and I told the clerk, I told the staff, said, bring me the bank account.

Bring me the reports. I'm gonna look at this. Right. Then a couple of days I found where we were off.

They'd been working on it for two weeks. Oh, wow. And they're like, how did you find that so quickly?

Can you explain it to me? I'm like, no, I can't explain it to you. It's like a, it just happened.

Ron Lyons (04:51):

Yeah. It's more like a gift. It's not, it's not a, a, an actual thing that you can learn. So, so you've always

been good at math. And then, uh, you guys live right now, you live up here in Collin County, obviously,

um, in Saxy, if I'm, if I'm right about that. That's correct. So Saxy, tell me about that city. What's going on

over there right now? I, I, I knew Saxe, oh my gosh, over 30 years ago, driving through there sometimes.

And has that grown over there?

Scott Grigg (05:18):

You know, the county is growing as a whole, but it seems like we're growing on the two corners. Mmhmm.

You guys are growing up here by leaps and bounds. Uh,

Ron Lyons (05:26):

Celina's not growing, and, uh, Celina's definitely not growing. No, no.

Scott Grigg (05:30):

Yeah. Yeah. I I only drove around 150,000 cones on the way up here. <laugh>. Um, you know, the, the

Texas flower, uh, is the, is the cone the orange

Ron Lyons (05:39):

Cone? Orange cone? That's right. Um,

Scott Grigg (05:41):

Saxy Wiley, you know, we're growing in the southeast corner. We're growing in the northwest corner.

And, uh, so those two count, those two parts of the county are growing by leaps and bounds. Saxy is one

of those unique cities that half of it's in one county, half of it's in another. Oh, wow. Okay. So, um, when

my wife and I got married, we had that luxury of, she lived in the Collin County side. Mm-hmm

<affirmative>. So we had that, um, option. Right. That we could live where I was or where she was.

Gotcha,

Ron Lyons (06:13):

Gotcha. So what is the other, is it Dallas County on the other side, or what county is it? Dallas. Okay.

Alright. Very good. So they're growing out there. Um, when you, when you got here today, of course, we

are in the, I always call it the famous blue house right off the square. And it, and it's, it's only famous

because it's like electric blue with a yellow door and a color that we had no, you know, pardon, painting

myself and my wife. It just, it kind of came that way to us. But right across the street, did you see what's

going on right across the street?

Scott Grigg (06:43):

You got cranes up, a lot of concrete going up <laugh>. Um, it is kind of like at the admin building. I don't

know if you've been to the admin building over in McKinney, Uhhuh, <affirmative>, but, um, I lost a

good portion of my parking. There's cranes going up. I've got a big, uh, portable AC unit, <laugh> for the

admin building right outside my office. So if you just, um, need to listen to some humming all day long,

come hang out in my office. I said just, yeah, just kind of hums all

Ron Lyons (07:11):

Day. Gotcha. So, well, you may hear a little bit of what's going on here outside as well. It just kinda

depends on how hot I've got these mics and, uh, hopefully we don't hear a lot of cranes and stuff today.

And, and more importantly, hopefully that crane over there doesn't fall this way today. That would not be

a good, it'd be, well, the tax assessor collector, uh, served just for a short amount of time and didn't, didn't

make it very long. He was in the middle of a podcast. We don't want that to happen. But tell me this, uh,

one of the things that I thought that was so timely and so interesting is the fact that, uh, property tax

statements just went out. If I, if I'm correct, I, or maybe I checked my mail late, maybe they went out a

long time ago and I'm just now getting all my mail. But it seems like they just arrived recently, is that

correct?

Scott Grigg (07:58):

Actually, it's not the property tax statements, it's our appraisal notices that came out. Okay. Can,

Ron Lyons (08:02):

Can you, can you explain the difference? I'm gonna, I'm gonna definitely, I don't have to play the role of a

person that doesn't know all about this because I don't know all about this, but it's interesting to me. So it's

not, those are appraisal notices, not the actual invoice, so to speak yet. Right. Okay. Tell, tell me all about

that. So

Scott Grigg (08:20):

The appraisal notices come from our central appraisal district. Uh, they don't come from my office. So

those came out on April 15th, and it's what the appraisal office decided that our properties were worth as

of January 1st of this year.

Ron Lyons (08:36):

Gotcha.

Scott Grigg (08:37):

Um, those rolled out on April 15th. By statute, we have 15, they always need to come out the 15th of

April. Okay. We have 30 days if we decide we want to protest that value,

Ron Lyons (08:49):

Meaning a homeowner, so a homeowner, I get a statement and they say, here's what we think that your

home is worth right now, your property, and that means the, the actual structures, the land value, et cetera.

And then what happens if I don't agree with that amount, if I think it's, if I think it's too high, I, I doubt

anybody ever think it was too low and want to argue that, that, Hey, I think y'all underestimated this, but

that's probably happened. But if I think it's too high, they've estimated it too high, what can I do about

that?

Scott Grigg (09:22):

Well, the process here is you go online and you can fill out an application online, and basically you're

putting the appraisal district on notice that you're planning to protest. And one of the things that they're

gonna ask you is what do you think it's worth? And you're gonna put a number in there, it starts kind of

informal. You're just gonna kind of talk to an appraiser, right. And you're gonna say, Hey, this is what I

think it is. And, and they're gonna look at it. They may give you an offer and they say, okay, you know,

we can see that. And they may give you an offer. You can either accept their offer and if you accept it,

you're done. If you don't accept it, then you're gonna move on to, uh, into the process.

Ron Lyons (10:04):

Okay.

Scott Grigg (10:05):

Um, the next step in the process is you go in front of a three person panel called our appraisal review

board.

Ron Lyons (10:11):

Okay.

Scott Grigg (10:12):

And you're gonna get a chance to present your case. They're gonna present their case, and they're gonna

make a decision. They may decide with you, they may decide with the appraisal district, they may meet

somewhere in the middle.

Ron Lyons (10:25):

Okay. Um,

Scott Grigg (10:27):

And then, then you have a decision to make. Are you gonna accept their decision?

Ron Lyons (10:32):

Okay.

Scott Grigg (10:33):

You can go farther, but like anything else, the farther you go, the more time and effort and money you're

going to put into it.

Ron Lyons (10:40):

Okay. So what, what would be the next step past that if, let's say you didn't agree with this, uh, a RB, this,

uh, appraisal review board mm-hmm <affirmative>. Um, what, what would be the next step? Does it then

actually go into like some sort of a court?

Scott Grigg (10:55):

You can go up to the, the district courts or you can file an appeal with the comptroller's office? Um,

there's actually a interesting bill that is being kind of talked about in Austin right now, that you can

actually go, if it passes, you'll be able to go in front of our justice of the court judges. Okay. As long as

the value of the taxes is under 20,000, because that's the value that a Justice court can hear.

Ron Lyons (11:26):

Okay. So like you could go into, like, uh, for example, over here, I think in Frisco is like JP court four.

Right. So that judge, uh, that JP or that justice of the piece, that JP would then be able to hear it as long as

the amount in question is under $20,000.

Scott Grigg (11:45):

But if the taxes due would be under 20,000.

Ron Lyons (11:47):

Gotcha. Okay.

Scott Grigg (11:48):

I mean, your dispute may be $50,000 as far as the value, but your taxes on that 50,000 is gonna be less

than 20,000. Gotcha. So you'd be able to go to the justice court. Um, one of the great benefits of that is the

fees at a justice court are much less than they are at the district court level.

Ron Lyons (12:07):

Right, right. So it saves, obviously it lowers the case load on the higher courts mm-hmm <affirmative>.

And I'm certain that they've probably got a few other things going on besides just, uh, you know,

somebody arguing over, you know, 20 or $30,000 valuation on their property or whatever. But

nonetheless, it lowers that case load. And like you said, the fees are less. So it sounds like a pretty good

deal. But that's not passed yet, that's just, uh, like a, a proposed bill or something that's just being kicked

around? Is that what that

Scott Grigg (12:36):

Is? Yeah, that's a bill that's been filed. Okay. And of course, it hasn't gone to a vote yet. It's been filed in

the house. Of course, if it passes then it'll have to go to the Senate. Gotcha.

Ron Lyons (12:44):

And,

Scott Grigg (12:44):

Uh, and then of course, when it gets passed, if it does get passed by both houses, then it'll go to the

governor and then it would take place. Um, I believe the way that one's worded, it'll take, uh, go into

effect, um, the 1st of September of this year.

Ron Lyons (12:59):

Gotcha. Wow. That's very good. So, so help me understand this. And, and some of this is gonna be maybe

in your wheelhouse and some of it not, because, you know, as of right now, I don't know who all has

specific responsibilities or jurisdiction or whatever in some of these different things, but just based on

your knowledge, how often is it that if someone decides to protest their taxes and goes to that a RB thing

and, and you know, disputes their taxes and decides to take that, that second step, they don't, they don't

settle with some sort of an online offer. Nothing gets worked out preliminarily, they go in person, they do

this little deal. How many of those cases actually reach some sort of a conclusion that's acceptable to both

sides, would you say?

Scott Grigg (13:46):

I think that's maybe a third.

Ron Lyons (13:48):

Okay. So maybe two thirds actually go past that. Then

Scott Grigg (13:54):

Two thirds they all get, they had to get to a 90%, about a 95% in order to be a certified role. Okay. So, but

as far as getting to where one person is completely happy about a third Oh, wow. Um, either that it just

gets to a point that no one's willing to take it any.

Ron Lyons (14:16):

I gotcha. I understand. So, because the, the, the time commitment, the expense, everything else, and, and

ultimately, obviously it's kinda like in a lot of civil action, if somebody says, Hey, well I'm gonna sue you

over this, uh, you know, we have a $5,000 fence we put up and you didn't pay us all the money we had

coming, you paid us half of it, $2,500. It may be worth it to go to JP court and fight that. But to try and

take that further and the court costs and everything else before long $2,500 is kind of, of, uh, a moot

point. Right. Because it costs too much. And so, you know, it, it may get in these cases where people are

like, well, I don't wanna, the filing fees are too much, the time commitment is too much, so I'm gonna go

ahead and settle with this number or whatever.

Ron Lyons (15:05):

But I remember now this is, this is going way back. I started doing real estate in the eighties. Okay. And I

remember back in the eighties, pretty much if you protested your taxes, there was no online anything. But

if you protested your taxes, they were gonna adjust it down for you. It was just you were taking the time,

making the effort to actually go down in front of the board and do that. They always came down. Um, I

don't think that's the case anymore. I think now it's changed a lot from what I understand. You can go in

front of the board and walk away with really no, no, uh, no win or, or whatever you wanna call it, no

adjustment in your favor. Are you aware of anything like that? Is that, is that, uh, do you have a

perspective on that?

Scott Grigg (15:51):

I think the availability of information and how quick we can get information does make it a little harder to

get your adjustment the way you want it. Um, and if you don't go in there organized and you don't go in

there with the right attitude, you're not gonna get anywhere. You know, back, say back in the eighties,

you couldn't get your comps as quickly.

Ron Lyons (16:16):

No. They were actually printed in books.

Scott Grigg (16:18):

Right. I mean, just like the, you know, nowadays we can pull up, you know, the maps and see where the

property lines and stuff are. Right. You know, um, we actually can, you got all the technology, you stick

something in the ground and you can get a pin right off your cell phone. Right. You know, I remember

selling real estate way back in the days too, and you're looking for that metal pin <laugh>, or you're

looking, it's true. You're, you're looking for that rock that someone painted purple. Right. You know?

Right. You know, uh, you know, next, next to the tree that, uh, someone cut down five years ago, <laugh>

and this, it's not as easy. You know, right now, tech, the technology we have, the information is so much

easier to get. Right. Um, you know, we, we do these classes. I've done these classes for over six years, uh,

going on seven years where I give advice and try to give people some guidelines on how to do this

protest. And I tell 'em, one of the first things I tell 'em is, guys have the right attitude.

Ron Lyons (17:22):

And, and what exactly, when you say have the right attitude, like what does that mean for someone, you

know, going in? Like, don't go in being like rude and mean and ugly Or like, what does that mean? If

Scott Grigg (17:36):

You go in there, um, with this attitude that they're a hundred percent wrong and you're a hundred percent

right? Mm-hmm <affirmative>. And how dare you do this to me? Um, they're gonna get defensive. Right.

And they're going to put their, you know, heels in. Right. They're gonna dig in and they're not gonna give

any

Ron Lyons (18:01):

Gotcha.

Scott Grigg (18:01):

Or if you go in there unorganized, I remember back in the day, one of the reasons that, uh, I changed my

major from being from A CPA is federal taxation. When they hand you this big box of random receipts

and they, you know, basically dumped it down. Right. That's one reason I did that. Yeah. That's not

wanted a CPA <laugh>. That's not fun. Wanna do that the rest of my life. Right. Um, if you're not

organized and you go in there, they're not gonna listen to you.

Ron Lyons (18:35):

Gotcha. So what do you need to take in with you when you go in there? Like what, what is the good data?

Because as a real estate person, myself, I have an awful lot of people right around this time, as you can

imagine asking me for comps. Mm-hmm. Like, everybody wants comps and they're trying to prove a

certain value on their property by using these comps mm-hmm <affirmative>. Um, and I don't know if

there's a necessarily a formula, like do you need to show more sold properties? Uh, things that are

currently listed, like what's the, what do people need to walk in with, in your opinion?

Scott Grigg (19:11):

Per the code? The value is supposed to be as close to January 1st. That's, that's the value. So first thing

you wanna do is you want to ask the appraisal district, what are your comps? What did you use to come to

this value?

Ron Lyons (19:25):

Gotcha.

Scott Grigg (19:26):

So they're gonna give you three or four properties that they use to come up with that. So as a real estate

agent, if I call you and say, Hey, I need your comps. You want to get your client things, it could be in

December, but you are wanting to get close to that first, first of year as you possibly can. Gotcha. Because

that's the value you're looking for what was on the first and do that comparison. So if you're looking at

that comparison and say you get the comps from the CAD and you look at those houses and then you try

to pick your house apart and figure out what does those houses have that yours doesn't. Okay. And I, and I

talk about this a lot. Our homes are by far probably our biggest investment, right. Both financially and

emotionally. This is the where we raise our family. We got the little tick marks where little Johnny grew

Ron Lyons (20:24):

Up. He grew up over the years. Right. That's right.

Scott Grigg (20:27):

Um, we, we got, we got that little dent in the, in the door where, you know, uh, someone came running

around the corner and didn't quite turn fast enough. <laugh>. Right. Um, we've got those emotional things

and we look at our homes. That's our home. It's not just a building, it's, it's our home. And I tell people all

the time when, when it comes down to protesting, you gotta not look at it that way.

Ron Lyons (20:53):

Take the emotion out.

Scott Grigg (20:54):

You gotta look at this place like it's the biggest dump on the block. <laugh>. You gotta take all that stuff

out. You gotta look at that mark on the door. Not as a memory as crap, I gotta fix this.

Ron Lyons (21:07):

Right.

Scott Grigg (21:09):

And you gotta figure out what it's gonna cost. And so once you figure out all those things that have to be

fixed, you know, you need new flooring. The shag carpet ain't gonna do the for mic. A countertops gotta

be replaced, the roof needs to be repaired. Uh, all those windows that have the seals broken and they all

look foggy. You know, like, like when you get in the car in the morning and it's fogged up 'cause your

defroster doesn't work very well. Right. Right. All those things that you need fixed, you gotta make a list

there. Gotcha. And that's not enough. Then you gotta make some phone calls. You gotta get written

estimates. 'cause it's not enough to go in there with a list of here's what you, here's the houses you

compared it to. Here's all the things I need to do to my house to compare to those houses.

Ron Lyons (21:59):

Gotcha.

Scott Grigg (21:59):

And you need written estimates so you can show the appraisal district, here's what it's gonna cost me to

bring my house up to those standards. Right. And it needs to be in writing. Doesn't mean you're gonna do

'em all, but you've gotta show them proof of what it's gonna cost.

Ron Lyons (22:19):

I understand.

Scott Grigg (22:20):

And, and if you go in there with that organized and you got the written proof, then you got an evidence,

you're proving the case. It's not a court of law. You're not a got a judge and a jury, but you got kind of a

jury. You got these three person panel there and you need at least two of the votes. You gotta convince

two of them that you're right. And the appraisal district's wrong.

Ron Lyons (22:45):

So you, you present all of this. They have their information, their data, you've got yours. And then do you

know, uh, just I guess protocol wise, like what happens next? Do they say, 'cause like you said, it's not a

court of law. They're not gonna say, alright, uh, closing arguments. They're not, they're not gonna do it

like that. But you've kind of said your piece, they've made their statements, they've stated their position

and provided their evidence, so to speak, of why your home is worth this much. What happens next?

Scott Grigg (23:17):

And like I said, they're gonna make a decision. They could go with the appraisal district and say, no, they,

you haven't convinced us that they're not Right. Or they could say, you, you've convinced us. You're right.

Ron Lyons (23:29):

And does this happen in real time in front of you? Or do they go behind closed doors and talk? What's

that like?

Scott Grigg (23:35):

It's all right there in front of you. And they publish those rules. One of the things that I get the benefit of

doing is I'm on the board for the cat mm-hmm <affirmative>. As the electric tax collector. I get to sit on

that board. And one of the things that the appraisal district, the a RB does, is they set those rules out and

those rules, those guidelines are published in the room. You can read those rules, they're online and it tells

you exactly how that hearing's gonna be held. Gotcha. And you can follow those and read it, and it tells

you exactly how the process is gonna work. They're gonna make the decision and then you're gonna walk

outta there and you, like I said, you accept their decision, then you're done. And they will then update it in

their system and it becomes part of the certified role. Gotcha. So they have to get all that done by July,

because that's when our school boards hold their budget hearings mm-hmm <affirmative>. And they set

their tax rate and they, so they, that's, that's their deadline. You know, there's, every year there's a cycle.

Right. And right now we're in that cycle of we're doing the initial appraisal values. Right.

Ron Lyons (24:47):

Right. So, so a lot of people, and I, and I've been asked this so many times because, you know, right now

is when I'm pulling all these comps for people and stuff. But I've been asked so many times, okay, when I

go down there, what's it gonna be like? And I go, what do you mean? And I already know what they

mean. 'cause I've been asked the question a thousand times. Well, I mean, is it like a dark room and like

they have a light shining on you and or, or is there a whole bunch of people watching, maybe there's a lot

of people down there and like you're, you have to say all this and do all this in front of a whole big

audience. Like what's it like? So can can you respond to that? In, in your experience, what is that situation

like?

Scott Grigg (25:25):

No, you've got your three person panel. You've got the appraisal district representative, the appraiser, and

you've got you. And like I said, both of you gonna present your case, the three person panel's gonna make

their decision and you're just in a small room, probably, probably numbers much bigger than what we're

sitting in right now. And it may not even be that big, depending on how they separat it out, um, during the

covid years actually did it on a Zoom. Right. Right. I remember that. Um, so, and like I said, you can go

online and you can read the rules. They set the guideline out and they, you know, of course a lot of it's

written in some kinda legally sometimes. Right. You know, uh, leave it up to government. <laugh>, we

have to make everything sound a little harder than it is a little

Ron Lyons (26:09):

Complicated. Right.

Scott Grigg (26:10):

Yeah. You know, we have to, uh, you know, double speak. Right. Everything. Um, but you know, it's one

of those things that the appraisal district, while it's not my job, it's not what I was elected to do, um, here's

my take on it, it's part of the process that in turn comes up with that tax statement that you first talked

about, which will come out in October. I feel that if I'm going to collect the funds, that in the end is the

end result of this process. I should know the process. Right. I should be able to answer those questions.

Um, I was elected to collect the taxes. And as that elected official, I feel I can do a better job, make sure

that the funds are collected properly. I should be able to answer the questions of all the taxpayers of how

did we get to this number? Right. If you're gonna write me a check of a thousand dollars, $5,000, and

believe it or not, I've gotten a million dollar checks from some of these commercial real estate people.

Sure. If you're gonna write me that check, I should be able to answer these type of questions. Right

Ron Lyons (27:27):

On. And we appreciate that, which is why I supported you in that election. 'cause I knew it would be like

this. And so, and I, and I would expect nothing less. You're you're doing exactly what I would expect you

to do. You, you, you're well versed in how this stuff works. I knew you'd be, I, I just knew ahead of time

before I asked you that you'd probably be willing to come here, talk about all of this stuff because you

care about this. You truly do. And so, and that was, that was a tough little election. That was a rough little

election for a minute. And you stayed very above board. And, uh, you had your truck with the, the

graphics on it and stuff. I have to ask you, you that was like a Chevy or a GMC pickup if I remember

right. Or Dodge? It's a Ford. A Ford, okay. I was way off. Okay. <laugh>. It shows what I, what I

remember. So you've got this pickup and you've got a, uh, you've got it all your name all over it and stuff.

Does that truck still exist right now? Absolutely. Does it still have all that stuff on it?

Scott Grigg (28:22):

Yes, it does.

Ron Lyons (28:23):

<laugh>. And will it stay that way?

Scott Grigg (28:26):

We're gonna do a little update on it. Okay. Uh, my wife, uh, told me the other day, you need to take the

word four off because you're no longer trying to be the tax collector. You are the tax collector. Right.

And, uh, so we're gonna do a little update on it and maybe do a little redesign. Good.

Ron Lyons (28:42):

Um,

Scott Grigg (28:42):

For those of you who haven't seen it, it's very patriotic. It is. Um, it is the beacon of a all things

conservative within Collin County. If you go into a patriotic event and you're not sure you're in the right

place, look for my truck <laugh>. Um, if you're looking for a patriotic event, you see my truck, you

know, you've arrived to where you're supposed to be.

Ron Lyons (29:03):

Exactly. So I have seen that truck quite a lot. And so you, you got through that election and it got a little,

got a little sticky at the end, but you, you overcame all that stuff. Um, and we're not gonna go back and

rehash all that stuff, but let's just say, you know, sometimes the, the very things that people despise most

about politics actually, you get to see 'em play out. And that's why it's called that, it's almost like a curse

word now. You say politics, it's like a bad word. And we're experiencing some of that right now in

Celina, unfortunately. Um, and I have become quite the proponent of taking politics as usual out of

politics. And that doesn't mean a lot of people say, oh, Ron, you've got this pie in this sky idea. Like,

that'll never happen. We're not gonna kumbaya and all get along.

Ron Lyons (29:52):

Not asking for that. I'm just asking that we treat each other with a certain level of dignity and respect. And

that we understand that for the majority, it's probably safe to say that we all want to improve whatever it

is that we're running for. Be it school board, city council, tax assessor, collector. For the most part, people

are getting in it because they've got a vision and they want to, you know, uh, carry that vision out to, you

know, existence. And unfortunately, the negative part of that is that you end up, I guess, in this modern

day where, you know, you have to, it's, it's dirty politics. Sometimes people do things in order to win

because they feel so strongly about winning, that they're willing to do things that, you know, it's not really

biblical. It's not really what, you know, I would think if, okay, if I was having this, uh, meeting right now

with my campaign team and Jesus was sitting right here, <laugh> in this chair, and we bounced this idea

around, would he be in favor of it or not?

Ron Lyons (31:03):

And I think a lot of times these things that you and I know as dirty politics, I think Jesus would say, no,

don't do that. Find another way to win this election. Do it in love. Do it with respect. Do it with all of the

things that I ask you to reflect. And that's not what that is. So did that experience you went through, did

that ruin you from, from politics now, or, or are you kinda good and, and uh, feel good about overcoming

all of that stuff? How do you feel about that after having gone through it now

Scott Grigg (31:39):

Know, I'm very proud of the race that we ran. I'm very proud of my team and uh, the great thing is that

every night I got to go to bed and I got to sleep with a good conscience

Ron Lyons (31:53):

That matters

Scott Grigg (31:53):

Because, um, I knew that if Jesus had been in that room, he would've been okay with the decisions we

make. Right. And, you know, there were times that, you know, it gets hard because I knew what I was

getting into. Um, it got hard because some of my loved ones, how it impacted them. Absolutely. Um, you

know, um, my wife, you know, that's not what she signed up for. Right.

Ron Lyons (32:33):

<laugh>,

Scott Grigg (32:34):

You know. Yeah. You know, as a mama bear, I guess is, you know, the term there, you know, she

protects those that she loves. Absolutely. And, um, there was days that um, it hurt, it bothered her of

course. And, um, we just kinda had to step away and, um, talk to the Lord and remind each other why we

were doing this. Right on. And, uh, this was my second campaign. We started dating towards the end of

my first one and where we came up a little short and I was asked, did you ever think about not running a

second time? And I can honestly say for about 15 seconds. Right. And that was because of a conversation

that her and I had. Hmm. We were planning our lives together, planning our future together. And I set her

down and I said, listen, this is not what you think we need to do. This is not where you want to go. I'm

done. We'll throw the campaign signs and the recycle. We'll take the name off the truck, not taking the

eagle of the flag off <laugh>, but I'll take the campaign sign off. Right. Um, and we will wait for God to

show us the next path. Right on. And it took her all about 15 seconds to say, absolutely not good. This is

where God has called you. This is where he wants you And I have been praying about this and I feel this

is where he needs you. And, um, so we, uh,

Scott Grigg (34:21):

We buckled down and we got to work. And, uh, you know, this was a, this was a labor of love. I mean,

we worked hard. Absolutely. This wasn't something that I, I didn't just write a check, go knock on a

couple of doors, put out a couple signs, and just lay back and hope that it came to me. Right. Um, tens of

thousands of doors, um, lots of time away from people I wanted to be with. Sure. Um, because

Scott Grigg (34:58):

I felt that's where God wanted me. Right on. And, uh, I, I get, I get to go to the office every morning. I

took a little time to spend with my dad last week and troubled me nuts. 'cause I didn't know what was

going on in my office. <laugh>, you know, I'm like, you know, I'm like, I don't have the lines of doing in

Plano today. <laugh>, you know, um, but, uh, I got a great staff. I got a great team. Right. And I know

they were taking care of the taxpayers of Collin County even though I wasn't there. Good, good. And um,

you know, that says a lot about my team and I know what they gotta accomplish. But, but yeah, there

were some times that, you know, looking down at the phone like, you know, what's my email doing? Ah,

<laugh>. Okay. We're doing okay. But, um, but no, that was, um, the politics side and you talk about it, if

I could have interviewed for the job and, and gotten it, I would've. Um, but that's not the way it's set up in

this state.

Ron Lyons (35:56):

That's not how it works.

Scott Grigg (35:58):

It, it, uh, you know, set up with the constitution, um, back in the 18 hundreds. Right. Um, which I think is

just a little bit before I started my first campaign <laugh>, um, you know,

Ron Lyons (36:06):

It's been

Scott Grigg (36:07):

Minute. Yeah. We, we, we, we, we joke, I may have run the longest campaign in history to be a tax

collector in the history of the world. Um, but, uh, like I said, it paid off. And I'm, I, I'm honored to serve

the taxpayers of Collin County and, um, and, and proud to be the tax collector.

Ron Lyons (36:23):

Well, I think we have good things ahead. I really, really appreciate everything you've done so far. And

lemme ask you this. So is part of what you do, does that also involve like the, um, collecting the, um,

automobile taxes and stuff like that? So is that portion, like you come down, like they do the title transfers

and stuff, like DMV type stuff, but there's, there's taxes paid whenever it's, uh, a vehicle, you know,

transaction takes place. So, uh, what's your involvement in any of that?

Scott Grigg (36:54):

Yes. We are actually a sub-agent of text DMV. Okay. So we do all the registrations. We register over a

million vehicles a year. Okay. Here in Collin County. We do all of the title transfers and we, the only

sales tax that the county collects here in Collin County is for vehicle sales. Oh,

Ron Lyons (37:14):

Wow.

Scott Grigg (37:15):

Um, we don't get to

Ron Lyons (37:16):

Steel six and a quarter percent.

Scott Grigg (37:17):

Yes. We don't get to keep a lot of that. 'cause most of that goes to the state, but the state is gracious

enough to give us a little bit. Um, I say a little bit, our part of it last year was about 17 million. Okay. So,

um, my office is one of the, um, few offices that can say that we actually bring more money into the

county than we spent. Good. So if, um, we just turn in our budget, my first official turning into the

budget, right. If, uh, I were to get everything I asked for, which, you know, that's not gonna happen.

<laugh>, uh, my operating budget would be about 9.5 million. Right. Um, but like I said, sales tax are,

part of the sales tax alone was 17 million. Good. As, um, as an agent of text EMV, um, you'll see on your

renewal statement, uh, like a 4 75, uh, handling fee. Right. Um, the state does give us a little bit of that.

Ron Lyons (38:17):

Okay.

Scott Grigg (38:18):

Also get a quarter for every vehicle registration that's done online. Oh,

Ron Lyons (38:22):

Wow.

Scott Grigg (38:23):

Um, you can also, a lot of people don't know this, but you can go to Kroger, several Kroger's and Tom

thumbs around the county and register your vehicle there if you don't, you know, don't wanna wait in line.

Right. So actually don't want to fight the construction at the McKinney office. And,

Ron Lyons (38:39):

And that is the biggest negative there right now. Right. Because they are redoing, uh, the, the, the building

right there. That admin building, is that Jack Hatchell or what is, what is that the name? Yeah.

Scott Grigg (38:50):

Is is the Hatchell building. Right. Um, and what they're doing is they're building a new medical services

center mm-hmm <affirmative>. Um, there was some federal grant money. It's saving the taxpayers close

to $400 million by being able to use some of these federal grants that come through. Um, unfortunately it

just make some parking difficulties.

Ron Lyons (39:09):

It does. Right now you literally can't, you can't park actually in front of the main door on that, on that

second level Yeah. To, to walk in. That's all blocked off. Right. And, uh, if it's raining, you, you've got a

little bit of a, you've got, you're gonna get a little wet unless you have an umbrella. But once you get

down there, let me say this, and you may or may not have even anything to do with this, but I think this

speaks volumes about what's going on down there. You think kind of like people tell me, okay, what's it

like going in for this, uh, this, uh, review board thing? Like I, I envision it's like a table or like you're on

the stand or something. It's nothing like that. And when you go in to pay for like a title transfer to do any

of that kind of business in that office, it is so streamlined and it is so amazing.

Ron Lyons (40:01):

I was in shock. You, you come up to a little kiosk, you get a number, and the waiting area is great. Um,

they've got lots of staff, everyone's doing their thing and they're fast, they're efficient. It was actually a

good experience and I did not expect that whatsoever. I thought old days, and I've been actually in that

office before when it wasn't so efficient. And you'd stand in a line and you didn't have any number and

you have to like, figure out which line do I need to be in? Oh, down, there's this and up, here's that. And if

you need a birth certificate, it's over there. If you need a marriage license, you come over here. It, it was

confusing. And I have to say right now it's not. It's good. It's really, really good. So what I don't, I don't

know, maybe you did all of that, maybe you didn't, but it's great right now. I I'm, I'm, I'm very happy with

that office down there right now. Well,

Scott Grigg (40:56):

I will give credit to my staff. Um, one of the things that we came into the office and, uh, is the morale.

Right. The work environment. Um, I wanted to make, that was my first thing. We're gonna improve the

work environment Nice. And not that people are doing cartwheels when they come to work, but they're

also not darty now there and burning rubber <laugh> to get outta the parking lot. Right. You know, we're,

we're having fun, we're laughing, we're smiling, we're enjoying being there. And, uh, even on those long

days, uh, you come in that, you know, there, you get your number and you know exactly where, what

window you need to go to, you're being called right there. And we're doing little things to try to make

things better every day. One of the things that I did my very first month there is gave out some service

pens. Oh

Ron Lyons (42:01):

Wow.

Scott Grigg (42:02):

Service pens have been sitting around for over a year. People who had not been recognized for their

service. I handed out a combined 160 years worth of service bins.

Ron Lyons (42:13):

Wow. That's awesome.

Scott Grigg (42:15):

Honoring those people for the service that they gave to the taxpayers of this count. Very good. And, um,

was proud to do that. Um, and like I said, those are just the little things that we did. We've had some fun.

Right. We're having some fun. Uh, earlier this month we did Autism Awareness Day. Mm. Where

everybody wore their autism awareness lighted up blue Right. Shirts. Right. Um, Wednesday we're gonna

wear, uh, with the Stars playoff games, we're gonna wear our victory green.

Ron Lyons (42:47):

Nice. Um,

Scott Grigg (42:48):

And just have a little fun with that and support our local hockey team. I'm a big hockey fan, so we're

gonna, you're wearing, you're actually wearing Dallas star, star shirt today? Yeah, I'm going. Yeah. So we

got a playoff game tonight, so Nice. We're gonna enjoy we're we're doing that kind of thing. And, um,

little things like that to try to make things better. Um, you know, just to give people some things to help

you a little bit. Uh, don't come around lunch <laugh>, um, things do get back. Not

Ron Lyons (43:17):

A good time. Right.

Scott Grigg (43:17):

Things get backed up a little at lunch, you know. Um, you know, they're happy, but they do get hungry,

so, you know, we don't need anybody hangry <laugh>. So, um, things get back up around lunch. Uh, we

do stop giving out title numbers or new resident numbers. About 30 minutes. 30 minutes before we close.

Okay. Because those transactions take longer. They do. And um, I found when I first got there, people

were coming in two minutes before we closed getting that title number and the staff, um, we closed at

four 30 and they were still in the office at 5 45.

Ron Lyons (43:53):

Gotcha.

Scott Grigg (43:53):

And, um, you know, I want, I want, I want our team to go home, spend time with their family and have

that balance. And so we cut that off 30 minutes before we close. Very

Ron Lyons (44:05):

Good. What, is it better to go towards like the, the beginning of the month, the middle or the end? Like

when's, when's the best time I, I understand. Don't go during lunchtime. So when's the best day or days or

week through the month in your opinion?

Scott Grigg (44:20):

Probably about the, from the, probably the, the 12th to the 22nd is probably your best time. It used to

slow down more. It doesn't seem to slow down much at all. <laugh>. Um, there some offices are a little, a

little less busy. Right. Uh, I'm not gonna say that any of the offices are not busy. Sure. Uh Right. If you

go right down the Dallas North tollway to the Frisco City Hall, we have an office there that seems to be

the little hidden gym Right. That people don't know about. Yep. Um,

Ron Lyons (44:53):

Been there a few times.

Scott Grigg (44:54):

Uh, the Frisco group, I'm not sure why that seems, they don't seem to wake up till lunch <laugh>. So, uh,

go in there about nine o'clock, eight, eight or nine o'clock in the morning, uh, a little faster to get in and

out.

Ron Lyons (45:06):

And that's in city hall if

Scott Grigg (45:07):

I any city hall. Right. Currently we're on the second floor. Right. We're, uh, going to be relocating us to

the first floor. Okay. That move's gonna happen in September. Oh, wow.

Ron Lyons (45:16):

Nice. So

Scott Grigg (45:16):

Just kind of keep that in mind. If, uh, if going down that route is a place we want to go again. We already

talked about the construction in McKinney. My busiest office location in the county is Plano.

Ron Lyons (45:29):

Oh

Scott Grigg (45:30):

Yeah. We do about walk-in traffic, about half of the walk-in traffic in the county comes through the Plano

office. Oh wow. Um, they do on average of about a hundred people a day, more on average, um, than the

other two offices.

Ron Lyons (45:44):

Gotcha, gotcha. So, so like you said, there, there are ways that you can avoid even having to go in at all if

all you're doing is renewing a registration or something like that, that's a Kroger thumb, thumb online

mm-hmm <affirmative>. And there's some limits on that stuff, I think. Uh, I don't remember what all the

limits are, but I mean, you can't, you know, there's like some, some some time limits, meaning Okay. If

your registration hasn't been expired, I'm just completely making this up. You probably know the dates

Exactly. But you know, uh, if, if your registration's been expired for two years, you can't do it at Kroger

or something like that. Right,

Scott Grigg (46:18):

Right. Uh, and just keep in mind, we don't do safety inspections anymore, but we live in an admissions

county, so you still have to do your admissions test. You can still do the same place you used to do your

safety inspections. Uh, it's just you have to do the admissions thing. So go in and you don't have to wait

till the month that you're due. You can do it 60 days before. Oh wow. Nine days

Ron Lyons (46:40):

Before.

Scott Grigg (46:41):

But keep in mind it's 90 days, not three months. Gotcha. So, um, I just kind of, people err on the side of

caution. Go in about 60, 70 days before your registration's due, do your missions test go online. Uh, if you

got your green notice, go to Kroger, go to the grocery store, uh, go to the county website, go to my page

tax assessor collector page. There's a list right there. If you've got any questions, email me. Tax

assessor@collincountytx.gov and you can find my cell phone, uh, on my campaign page, my Facebook

page. It's 4 6 9 8 3 4 3 5 8 8. Um, just gimme a little time to sometimes respond. Um, I take calls till about

9, 9 30 and then I'm done.

Ron Lyons (47:29):

You may get a few more now. Yeah,

Scott Grigg (47:30):

I'm not answering, I'm not answering calls after nine 30 made that mistake was on the phone till about 11

o'clock, 1131 night. We're not,

Ron Lyons (47:37):

Not doing that anymore. So I feel, so I feel pretty good because I think I texted you around that time on,

uh, I feel like it was maybe even like a week. And I don't remember when I texted you, but I felt like I

was pushing it a little bit with when I texted you. But I'm that kind of person. Like I do this, I run 900

miles an hour all day, all day, all day. And then I find myself thinking that it's like seven 30 at night and

I'll text someone, I'll say, Hey, how about this or this or this or this. And I'll look back, oh my gosh, it's 10

o'clock. You know, I don't realize. And so I make that mistake. I know I didn't text you at 10, but it was

pretty late. And, uh, you were gracious enough to respond and I appreciate that very much. Giving out

your phone number right here on this show. We have 6,000 people that are gonna listen to this show. You

just gave your phone number out to 6,000 people. That's, that's, that's, that's remarkable. I appreciate that

very much. Well,

Scott Grigg (48:30):

When I decided to run, I wanted to make myself available and I wanted to be that elected official that was

available for the taxpayers.

Ron Lyons (48:40):

Nice.

Scott Grigg (48:41):

Uh, one of the things that, um, used to be a, I used to be an auditor for the county and it used to drive me

nuts when I needed to talk to an elected official, I couldn't find them. Right.

Ron Lyons (48:51):

Uh,

Scott Grigg (48:51):

Or I'd hear people in the political world that would say No, only see them when they wanna vote

Ron Lyons (48:57):

<laugh>. Um,

Scott Grigg (48:59):

I don't wanna be that person. Thank you. I don't want to, um, you know, I do, I will say I do go home a

little more often. Right. I'm not at meetings every single night. Sure. Um, I changed my focus from

political events to community events. Right. You know, and, um, but, uh, I tried to go home, eat dinner

with my wife more.

Ron Lyons (49:22):

Right, right. Um, that's a good thing

Scott Grigg (49:24):

To do. Yeah. Um, I, there's probably nights that she wishes I was gone more <laugh>. Um, but, uh, no,

she's, she's a sweetheart. She's a saint. But, um, yeah, I love spending time with her, but there, I've kind of

changed my focus that it's not, it's about the community. Right. That I've been elected to serve and I want

to do that. And, uh, like I said before, it is my honor and I'm, you know, proud to do it.

Ron Lyons (49:49):

Well, I appreciate you coming here today. And we're right in the middle of that kind of assessment time.

So the assessment notice has gone out. We have a deadline of when do they need to be submitted? Back?

May the 15th.

Scott Grigg (50:02):

May 15th is you need to, you need to let the appraisal district know that your intention is to file a protest.

Okay. That doesn't necessarily, and they're going to, like I said, you're gonna get an informal meeting

with an appraiser. Uh, you can try going up to the appraisal district and just ask 'em to talk to an

appraiser. Sometimes they, they're available, sometimes they're not. Right. Uh, and, and sometimes they'll

come out and talk to you and you can settle it right then. But, uh, you've gotta let them know before May

15th. 'cause you miss that deadline. You're just Yeah. You're stuck until next year. Right

Ron Lyons (50:34):

On. Um,

Scott Grigg (50:34):

And one of the things that I will say that guys, this is step one. If you file your protest for your appraisal,

that's only one half of that equation. You know, the, uh, the title is assessor Collector. The only assessing

I do is I take your appraised value and I take the tax rate set by your entities, and then I send you a, a

statement. That statement that we started this conversation with comes out in October.

Ron Lyons (51:05):

Gotcha.

Scott Grigg (51:07):

And I'm gonna try to get it out as close to the first of the month as I can.

Ron Lyons (51:11):

How many, how many do you think you guys are sending out this year?

Scott Grigg (51:15):

We, we collected, we have about 450,000 parcels. Okay. And we issue about 500,000 receipts. Wow. In

property tax alone. Um, overall about 1.8 million separate receipts with our motor vehicle. Right. And

collect over $4 billion Nice. In my office. Um, and, uh, and we balance that every day. To the penny.

Ron Lyons (51:44):

To the penny,

Scott Grigg (51:45):

To the penny. And, um, like I said, you got a good crew that does that. It's hard to believe that what I

collect today for property tax will be balanced tomorrow and it will be in the bank accounts of your cities

and schools on Wednesday. Wow.

Ron Lyons (52:02):

That's

Scott Grigg (52:03):

Awesome. So that they can, uh, pay their bills. Right. And provide the services that you expect. That's

awesome to, to pay. So it's, uh, very streamlined. It's, uh, lots of checks and balances when having any

other way. And, um, my audit nature, my fraud examiner nature, that's just the way it is. Uh, so always

looking over to their shoulder. Uh, my poor finance manager, I told her from day one, I used to hold your

job, so you are probably gonna get, uh, me looking in your office more than any other person because I

used to have your job. I like it and I know it better than any other job at this office. Right. So, uh, but, uh,

no, she's doing a great job as the entire, uh, finance team is. So, uh,

Ron Lyons (52:53):

Well, I feel like if everybody just, you know, the, the public in general, and obviously you're in an elected

position and there's a certain amount of accountability that comes along with all of these jobs, whether it

be, uh, a staff position that's not elected or whether it be an elected position, like you hold, um, you know,

we're, we're learning that we, that we want, we, we no longer wanna look at government and say, it's just

ineffective. It's just government, it's just bureaucracy, it's all that stuff. Like it can be better. You're

proving it right now that it can be better. So I I I'm gonna say it like this and I'm not throwing any shade

at, uh, any particular fast food restaurants, but I'd rather you be the Chick-fil-A version <laugh> of the tax

assessor collector office than some of the other places. Okay. If that makes sense. I'd rather you keep

doing what you're doing, keep streamlining that process. Keep the morale high, keep, you know, keep

these dates and, and, and keep the accessibility. I mean, this is so different than the way that, you know,

we've all come to expect it and I like it. So I appreciate the fact that you came here today. Is there

anything else that we didn't really cover that you'd like to talk about?

Scott Grigg (54:04):

No, like I said, it's accountability, transparency, that's what I'm I, when I ran on, that's what I'm working

on. And we're gonna keep, uh, working towards that. There's a lot of things that we're trying to keep

getting cleaned up and we'll constantly try to improve. My attitude for the office is this, I have a lot of

laws to fo follow. Um, do you ever have trouble sleeping? I'll loan you my copy of the tax code <laugh>

and uh, it usually sits on my desk. I reference it a lot. Right. My, uh, probably my least favorite part of the

job is I have to follow the tax code. And sometimes I don't necessarily agree with it. Right on. But I have

to follow it. Sure. And that's what I, there's a lot of laws that I have to follow. Uh, my staff is learning, uh,

very quickly.

Scott Grigg (54:54):

When they ask me a question, my first question to them is, what does the law say? Nice. Because that's

the way we're gonna, we're gonna follow the law, and if the law is gray, then we're gonna be consistent in

how we handle things. Good. Uh, that's what they um, 'cause we're gonna be fair. We're gonna be

consistent, and it doesn't always fit into a nice little box, but we're gonna follow the law. And, uh, so I'm,

I'm proud of that. I've built a relationship with the people we have in Austin, and I follow what they're

doing. And, um, so to me, the law is the minimum of what I have.

Ron Lyons (55:30):

Right.

Scott Grigg (55:32):

That just because I follow the law doesn't mean that's all I have to do. Right.

Ron Lyons (55:35):

On

Scott Grigg (55:36):

The citizens of Collin County deserve more. They deserve better. They deserve beyond what I'm required

to do. I have partners and I, uh, the, the appraisal districts I work with, the entities that I work with, the

schools, the cities, the county, the college, all the car dealers, those are all my partners. Yes. They have no

choice but to come to me. The car dealers can't go get their titles anywhere else. Right. They have to

come to my office. Right. But that doesn't mean I don't need to give them the best service possible.

Ron Lyons (56:14):

Absolutely.

Scott Grigg (56:14):

Because when you go to get a new car, I don't take care of what they give the title and do the work

properly, then you're stuck driving around without the proper tags. Right. So I need to work with that car

dealership to get their paperwork processed in a timely manner so that you, the taxpayer is taken care of.

We're partners in this. I like

Ron Lyons (56:38):

It.

Scott Grigg (56:39):

So I see those partners. Very good. I have lots of partners in this deal, and I work for the taxpayer.

Someone asked me the other day, I, I left, I was gone my on some way and it was left about five minutes

early. Who told you you could leave early? I said, well, I just got a meeting to go to. Well, who's your

boss? You are nice. He's there. The taxpayer nice. So, um, I don't know. Um, don't need another way to

do it. <laugh>. It just, it's good stuff though. I, God, you know, like I said, I was away for a few days. It

was an important thing. I needed to go see my dad. I needed to check on him. Right. Uh, is important

stuff to do. But, um, even my wife's like, honey, your crew's got this right on. You don't need to worry

about it. And I knew that. And, uh, but I did come in this morning and, uh, it's like, okay, what I miss

<laugh>, uh, and they're like, we're fine. I, so I know you're fine. I just wanna know what I missed. So,

very good. But I, I do appreciate you having me out here and, um, anything else that comes up, if

anything I can do for you guys, please let me know. Yeah, I think, uh, because that's what I'm here

Ron Lyons (57:51):

For. Maybe what I'd like to do is, uh, let's get past some of this political stuff. Let's get past some of this,

uh, tax stuff that's going on right now. Let's get, let's get past some of this stuff and then, uh, let's maybe

reconvene, come back for a part two and let's learn a little bit more about you personally. And, uh, I'd

love to know, I know you're over in Celina quite a bit. I'd like to talk to you a little bit about Celina and

some stuff like that. So let's, let's do a part two. Would you do that?

Scott Grigg (58:16):

Absolutely.

Ron Lyons (58:17):

All right. Awesome. And guys, that is Scott Greg,

Ron Lyons (58:22):

We hope you enjoyed this episode of the Celina Radio podcast. You can reach the host Ron Lyons at 2 1

4 7 8 3 5 4 4 0. You can also email him at ron@ronlyons.com. If you'd like to be a guest on the Celina

Radio podcast, go to Celina radio.com and fill out the guest interest form. And until next time, guys, as

we always say, stay safe and God bless.